Post-pandemic era healthcare labor costs rose to crisis levels across the country. Much of these costs were fueled by the sudden surge in agency nursing labor costs. Supplemental labor became a growing percentage of total workforce expense. Since workforce comprises the greatest cost to healthcare institutions, this caused financial stress in systems around the country.

Despite Federal and some State assistance, these funds could not match the growth in demand. Crisis rates for travel nurse contracts were at an unsustainable level. Members of congress had even communicated with the White House that they felt these rates were the result of price gouging by vendors. One executive in the industry stated that blaming staffing agencies for the cost of their services was like blaming realtors for the cost of housing. These calls for legislative intervention soon died as the crisis began to pass, and rates took a precipitous decline.

Despite drops in billing rates nationwide, contract labor in the healthcare segment is still more than double pre-pandemic levels. Recent reports from Staffing Industry Analysts show a 240% increase in estimated spend for 2024 compared to just five years ago. In 2019 overall spend was $18.9 billion while estimates for 2024 are $46.2 billion.

Why are we here?

It’s easy to assume cause and effect is at play, due to the continued nursing shortage. However, the shortage applies to temporary staffing agencies as well. If billing rates are down, but the overall spend is more than double pre-pandemic levels, simple math says more units of labor are being used. (i.e. temporary staff) This brings up another question to be addressed which is; are agencies now outperforming hospitals in the race to hire new talent?

History provides some clues. In the decade of the 2000s, several Managed Service Providers (MSPs) were created especially for the healthcare staffing marketplace. Although Ford Motor company had been using this type of technology since the 60s, it would take a while for the technology to address the unique complexities of the healthcare environment.

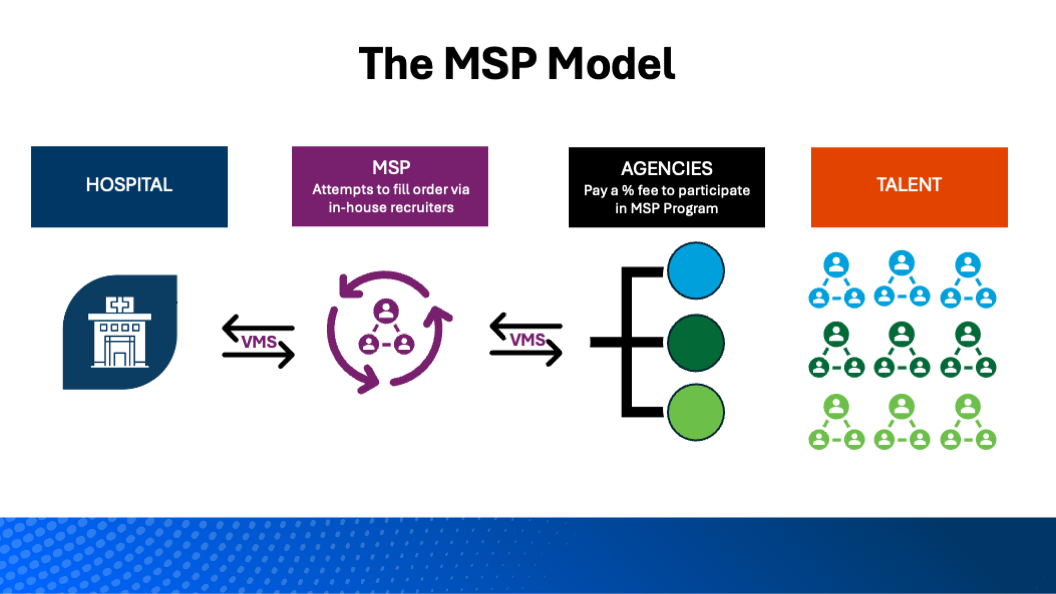

What did the MSPs provide? The concept has always been simple, yet effective. Prior to the MSP revolution, hospitals were having to single-handedly deal with a multitude of staffing vendors as well as a multitude of invoices and contract workers every week. The MSP technology was the perfect answer to streamline these activities and funnel them into a single source. Requests for staff would go to a singular location using Vendor Management System (VMS) software, and in turn, the MSP would broadcast these needs to as many agencies as the hospital desired.

The agencies would then propose candidates to the MSP vis the VMS software, and in turn the MSP vetted theses candidates and submitted to the hospital for temporary assignments. The candidates’ working hours would be turned into the MSP and the MSP would calculate one invoice for the hospital, then return to the participating agencies their share of the billing for the candidates working.

This model worked extremely well for a decade as it forced direct competition between agencies nationwide allowing for true price comparisons. In this environment, smaller agencies had the ability to compete on equal footing for price and quality with the big guys.

This market would go through a radical transformation beginning the decade of 2010. Seeking an advantage in the staffing market, larger staffing firms decided these technology firms had two great assets that are fuel to their business;

-

- An existing contract for staffing with the hospital, and

- Complete control over all requests for temporary staff

A buying frenzy ensued with larger agencies looking to purchase any MSP with direct ties to hospitals. In addition, staffing firms would start the process of building their own VMS software to run their own MSP.

Some speculate that these agency-owned MSPs are turning their hospital requests over to their own commissioned recruiters to get a head start on competing agencies.

Although market neutrality is highly touted, an observer would see the shrinkage of the number of agencies in the market as a potential warning sign.

An early marketing practice of these MSPs was to explain that there was no charge to the hospitals for this service. That axiom was accurate in that the hospitals did not make any direct payments to the MSP. Although possibly misleading, the fees that MSPs charge are actually pulled from the payments made by the hospitals before passing on the balance to the participating agencies.

A simple example would be a hospital pays an MSP for the total billed amount of $10 million. If the MSP is charging the agencies 5%, that takes $500,000 from the hospital bill while passing only $9.5Million. The true cost for service in this instance is $500,000.00.

Today, hospitals are realizing true costs of these services and are starting to ask for rebates from their MSP, which should have been done long ago. Unfortunately, the hospitals are still not in a position to dictate how much of the administrative fees they should recoup.

The original question: Why contract labor has found a new normal at 240% over the 2019 levels. Market behavior is the answer. Anytime the number of providers is limited, there will always be a concurrent limit of choice. The number of healthcare staffing agencies that comprise over 50% market share has been cut in half in the last decade. More revenue is flowing to fewer companies. A reduction in choice typically leads to a reduction in price leverage for the consumer.

Healthcare staffing firms around the country have complained that although are not one of the largest providers, they can match quality and beat price in many instances. If they have not been included in the MSP approved list of vendors, it’s unlikely the client will ever learn of their better pricing. Another troubling concern of pricing is the ability of an agency owned MSP to take the published rate from the client, and reduce that rate to their subcontractors. This practice not only provides admin fees to the MSP, but additional earnings from the difference in their bill rate and hospital bill rate.

This lack of disintermediation, or “friction” in markets is contrary to best practices and by its nature will keep costs elevated.

Fortunately, hospitals today are using technology to take back control of the MSP market, aiming for fair pricing, a free market and transparency across all vendors, with a goal of establishing fair pricing and transparency across all vendors (See how one health system did it), this approach seeks to reintroduce competition and mitigate the rising costs associated with contract labor. In this way, hospitals are echoing the ethos of early MSP technology but with refinements that make it a more equitable and efficient model.

Ready to take control of your contract labor spend?

ABOUT THE AUTHOR

President, BlueSky Synergy

Tim is a thought leader in the contingent labor market place. His latest technology approach takes advantage of hospitals developing their own “gig” workforce. This technology is similar to what staffing agencies have enjoyed for years.